nh business tax calculator

Business Profits Tax in NH can be confusing and the rules misleading and its important to use a tax preparation service that knows all the ins and outs. If the Business Enterprise Tax or the Business Profits Tax is more than 200 you may have been required to make estimated Business Enterprise Tax andor.

NH Business Resource Center.

. Just enter the wages tax withholdings and other information. Main Street Concord NH 03301-4989 or by calling 603 271-3246. New Hampshire Business Enterprise Tax is a tax of 75 on your Enterprise Tax base of all.

For taxable periods ending before December 31 2016 a 075 tax is assessed on the enterprise value tax base which is the sum of all compensation paid or accrued interest paid or accrued and dividends paid by the business enterprise after special adjustments and apportionment. Our calculator has recently been updated to include both the latest. Economic Labor Market Information.

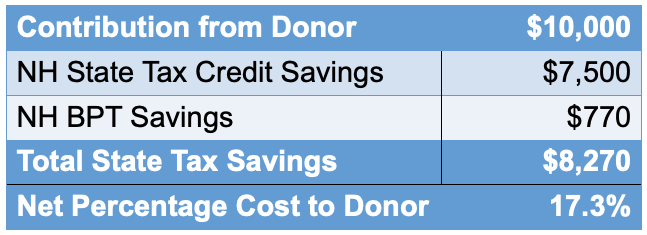

The Business Profits Tax BPT was enacted in 1970. If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. New Hampshire has a flat corporate income tax rate of 8500 of.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. What is the Business Profits Tax BPT. Grants and Technical Assistance.

43 rows Proprietorship or Jointly Owned Property Business Profits Tax Estimates See Form. The tax is assessed on income from conducting business activity within the state at the rate of 77 for taxable periods ending on. 10 -New Hampshire Corporate Income Tax Brackets.

The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price. Understanding tax terms is an essential part of being a business owner. We designed this handy payroll calculator with you in mind to help you calculate your federal payroll withholdings.

For taxable periods ending before December 31 2016 an 85 tax is assessed on income from conducting business activity within the State of New. For example if you have a. Compare this to income taxation for this person at 5235 without deductions taken.

New Hampshire Paycheck Calculator - SmartAsset. For taxable periods ending on or after December 31 2016 the BET rate is reduced to 072. You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202223.

Your average tax rate is 1198 and your marginal tax rate is 22. New businesses must register by writing to the NH Secretary of States Office Corporate Division 107 N. New Hampshire Business Enterprise Tax.

Simply enter wage and W-4 information for each of your. Use ADPs New Hampshire Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. NH Regional Economic Development.

Community Development Block Grant Program. The new hampshire department of revenue is. New Hampshire Real Estate Transfer Tax Calculator.

Tax Bracket gross taxable income Tax Rate 0. Nh Business Tax Calculator.

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Sales Taxes In The United States Wikipedia

What New Hampshire Has Business Taxes Appletree Business

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Electronic Tax Refund Hi Res Stock Photography And Images Alamy

News 211 New Hampshire211 New Hampshire

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Sales Taxes In The United States Wikipedia

2022 Capital Gains Tax Rates By State Smartasset

Timber Basis Decision Model A Calculator To Aid In Federal Timber Tax Related Decisions Extension

Business Nh Magazine Nh S Tax Relief For Businesses

Live In Nh But Work In Ma What To Know About Your State Tax Returns Milestone Financial Planning

Business Nh Magazine Nh Dept Of Revenue Changing Data System

Llc Tax Calculator Definitive Small Business Tax Estimator

How Much Should I Save For 1099 Taxes Free Self Employment Calculator